Computer depreciation life

The tax rules for treating computer software costs can be complex. Alternatively you can depreciate the acquisition cost over a 5-year recovery period in the year.

Depreciation Nonprofit Accounting Basics

The table specifies asset lives for property subject to depreciation under the general depreciation system provided in section 168 a of the IRC or the alternative depreciation system provided in.

. The following information shall also be disclosed in the accounts namely. If the computer has a residual value in 3 years of 200 then depreciation would be calculated. Under this depreciation regime the asset depreciation calculation is based on a staggered formula whereupon asset classes are designated a life span such as automobiles and light.

DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash Value. The computer will be depreciated at 33333 per year for 3 years 1000 3 years. You are right that computers are depreciated over 5 years.

Control systems excluding personal computer s 10 years. However the normal useful life which is the basis for depreciation. Alternatively you can depreciate the acquisition cost over a 5-year recovery period in the year you place the computer in service if you dont elect to expense any of the cost under section 179.

Heres a basic overview to determine the tax treatment of the expenses. The computer will be depreciated at 33333 per year for 3 years 1000 3 years. Ii The useful lives of the assets for computing depreciation if they are different from the life specified in the.

Depreciation on computer hardware and software over 1 year possible BACKGROUND. Computers effective life of 4 years Under the depreciation formula this converts to a Diminishing Value percentage rate of 50 per annum or Prime Cost 25 MobilePortable. Soft drink cordial and syrup manufacturing.

The cases in which the costs are. From Jan 1 2021. Cost of mainframe computer systems servers and telecommunications equipment is capitalized when the purchase is equal to or greater than 50000 and.

You would normally use MACRS GDS 5 year 200 declining balance to depreciate.

Usa Real Estate Agents Tax Deduction Cheat Sheet Are You Claiming All Your Allowable Expenses Real Estate Checklist Real Estate Tips Real Estate Marketing

Depreciation In Excel Excel Tutorials Microsoft Excel Tutorial Excel Shortcuts

Depreciation In Income Tax Accounting Taxation Income Tax Income Energy Saving Devices

Depreciation Formula Calculate Depreciation Expense

Depreciation Nonprofit Accounting Basics

Inventory And Depreciation How To Be Outgoing Software Development Working Late

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Computer Generation Excel

P Amp L Statement Template Luxury P L Spreadsheet Inside Free Pl Statement Template Profit And Loss Statement Statement Template Small Business Plan Template

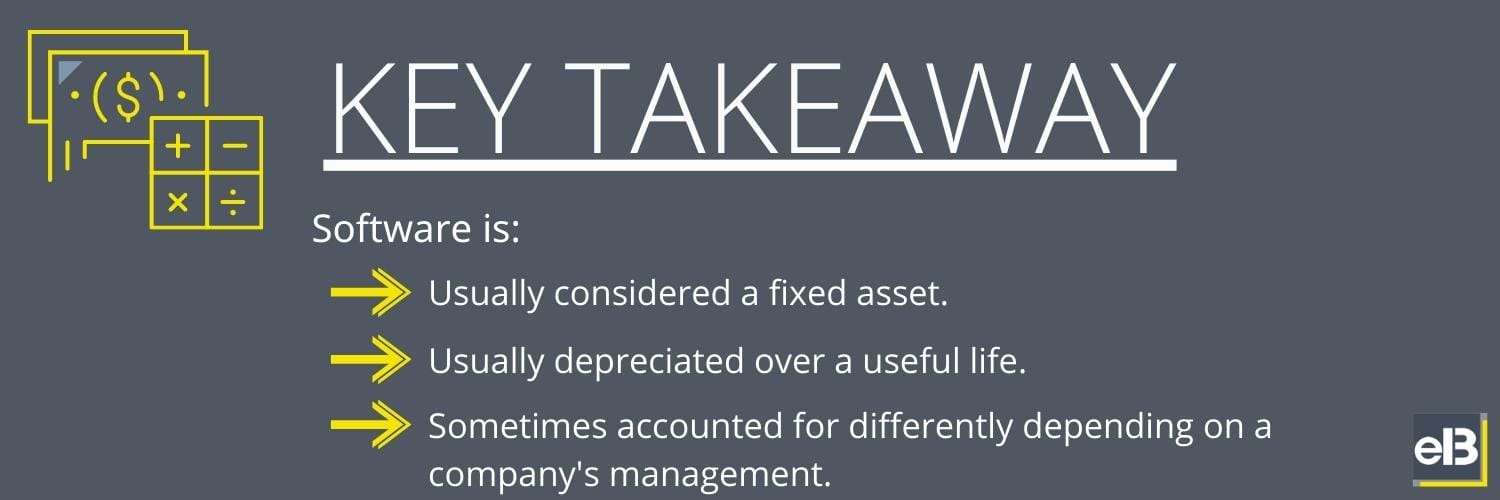

The Basics Of Computer Software Depreciation Common Questions Answered

Declining Balance Depreciation Calculator Double Entry Bookkeeping Calculator Bookkeeping Accounting And Finance

Depreciation In Excel

Depreciation In Excel Excel Tutorials Schedule Template Excel

Straight Line Depreciation Calculator With Printable Schedule Best Money Saving Tips Family Money Advertising Costs

Methods Of Depreciation Learn Accounting Method Accounting And Finance

Declining Balance Depreciation Schedule Calculator Double Entry Bookkeeping Bookkeeping Templates Accounting Basics Learn Accounting

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

How To Calculate Depreciation Expense For Business Online Accounting Software Accounting Books Business